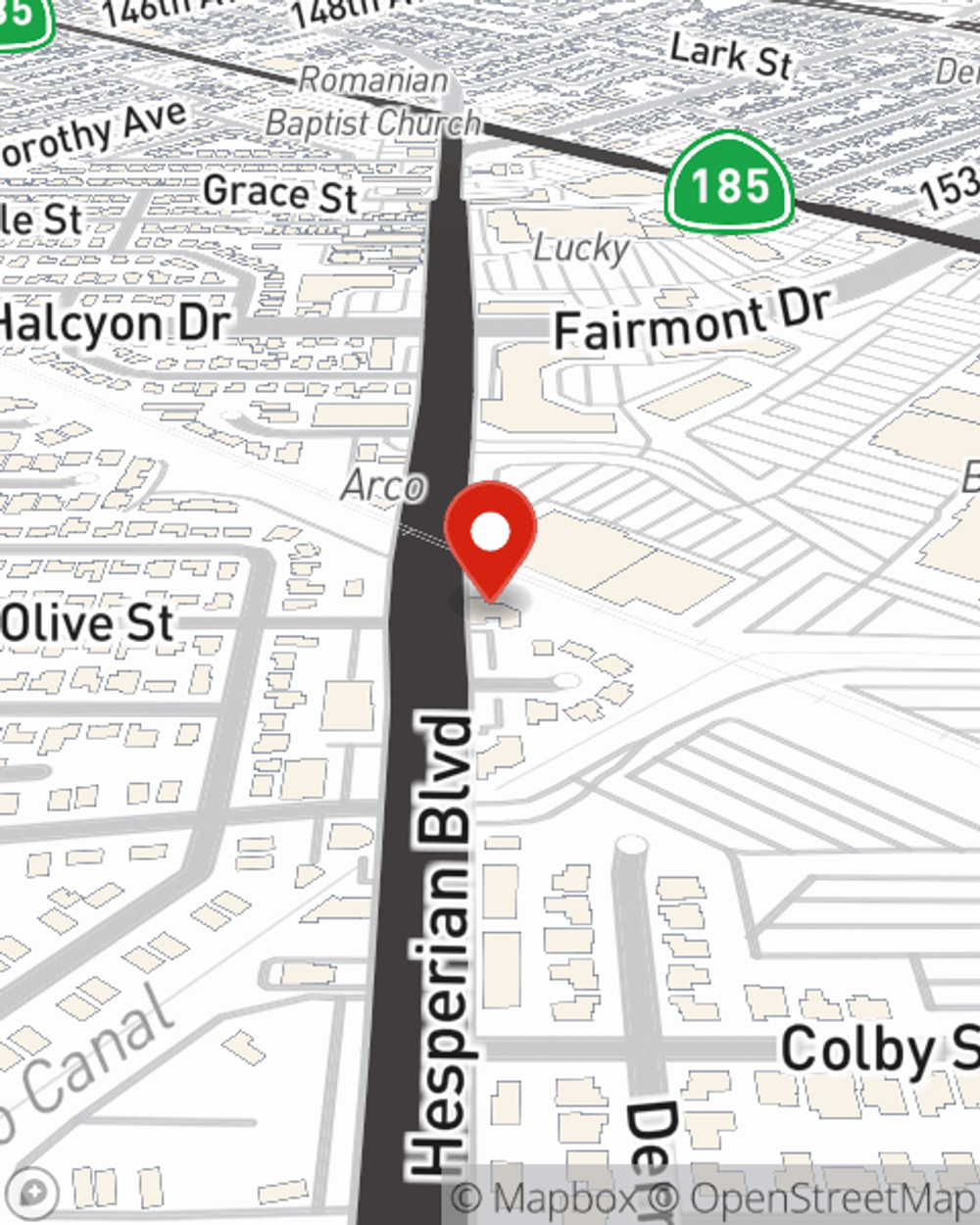

Business Insurance in and around San Leandro

One of San Leandro’s top choices for small business insurance.

This small business insurance is not risky

This Coverage Is Worth It.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all alone. As someone who also runs a business, State Farm agent Ed Spijker is aware of the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to look into.

One of San Leandro’s top choices for small business insurance.

This small business insurance is not risky

Strictly Business With State Farm

Whether you are an HVAC contractor an optician, or you own an appliance store, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Ed Spijker can help you discover coverage that's right for you and your business. Your business policy can cover things such as computers and buildings you own.

Visit the exceptional team at agent Ed Spijker's office to help determine the options that may be right for you and your small business.

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Ed Spijker

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.